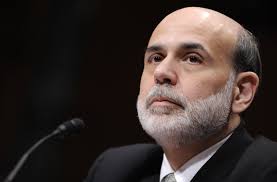

If you are expecting our healthy trend of the economic recovery to continue tit for tat on this spat of regeneration, hold on to your horses. While the recovery is speeding along at a very rapid pace – all things considered, the housing fallout was the worst since the Great Depression, and in effect, was actually worse than it considering our current population demographics – Federal Reserve Chairman Ben Bernanke says that we shouldn’t get too giddy about unemployment rates dropping to healthier levels until about three years from now.

“There still seems to be quite a bit of unused resources, people that could be working, capital that could be used and is not being used,” Bernanke stated regarding the economic health of our country. “We believe the monetary policies that we’ve conducted have helped get stronger recovery and more jobs than we otherwise would have had.”

Based upon estimates that were recently conducted by the Fed, Bernanke said, “We’ve helped create many private sector jobs, government jobs to support the economy quite significantly.”

In January, unemployment rates were still hovering around 7.9%. And based upon those calculations, Bernanke feels strongly that it’s still about three years out until we have a lower rate of around 6%. The Federal Reserve also committed to keeping interest rates low until we hit at least 6.5% unemployment.

Bernanke was confident that interest rates would remain low – as they are now. But he cautiously warned that with the spending cuts due to take effect this Friday (read our related article on this), it could undermine the healthy recovery that we are currently enjoying. Paramount to that recovery is the housing market, which boasted the fewest houses per sale in five years this week, a number that stifled buyers and create the always desirable seller’s market.

His solution is a graduating approach to recovery, “The more gradual this is, as long as there is offsetting changes in the further horizon, the less the immediate impact will be on jobs and growth in this recovery in 2013,” he said.

“I think there is some cost to the economy of these repeated, I won’t say ‘crises,’ but these repeated episodes where Congress is unable to come to some agreement and therefore some automatic thing kicks in, I think that’s on the whole not a good thing for confidence.”

Invest Smart Asset Protection and Investment News

Invest Smart Asset Protection and Investment News